As consumers demand easier and instantaneous access to their financial services, the reliance on technology by financial firms has increased, bringing greater risks to the availability and stability of the financial sector. These risks are intensified by the increasing adoption of fintech, the greater use of (and reliance on) outsourcing and the pervasiveness of cyber-threats.

A combination of factors has led to concern by supervisory authorities that UK financial firms are not prepared or equipped, and therefore not resilient, to deal with them as they arise. These concerns have been encapsulated in the need of UK financial firms to have what has become known as Operational Resilience (OpRes). As a direct action, on 5th December 2019, UK regulators published a series of consultation papers on operational resilience.

We understand that now is a period of great change in many financial services organisations with new guidance and regulations on business resilience and impact tolerances now due from the consultation and that outsourcing and use of Cloud technology is changing the IT estate in many existing facilities.

The consultation closed on 3rd April 2020, the PRA and FCA aim to publish their final OpRes policies in the second half of 2020, requiring financial firms to implement the rules during the second half of 2021.

The result of the consultation will mean organisations will not be able to apply a blanket approach to an OpRes project and will not be able to buy an off-the-shelf solution to upgrading any system. Identifying the firm’s business risk perspective is, therefore, a crucial first step before embarking on an OpRes transformation project coupled with sourcing a partner that has a robust understanding and experience in such projects.

Future loads and building occupancies are less certain than ever before, with IT and facility managers needing to balance sufficient provision against commitments to reduce energy use and overall running costs. In addition, the challenges of space, floor loading and providing suitable environments for batteries, UPS systems and generators still remain even as noise, access and pollution restrictions become stricter.

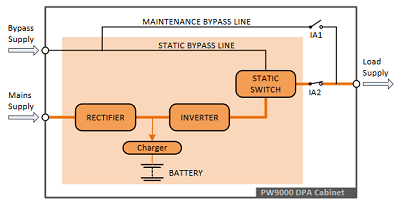

As UPS power protection evolves, and those looking after systems for financial services must cover ever greater responsibilities, KUP recognises the challenge ever-changing technologies presents. KUP’s long history of serving the financial services industry, compliance knowledge and UPS service expertise enables it to offer credible power protection audits and to advise on both estate modernisation and new UPS system design. Uninterruptible power supplies include single and three-phase systems, standalone and modular UPS options, with the latter being especially well suited to UPS installations where the future load is uncertain, or the load varies.

In addition to the uninterruptible power supply and emergency lighting inverter products, the KUP engineering team is experienced at designing UPS back-up battery systems that suit specific building layouts, autonomy needs and UPS monitoring requirements. KUP’s standby generators can be specified with a range of fuel and engine types, including KOHLER’s own low emission, high-efficiency models.